How I Mastered Social Spending Without Killing the Vibe

We’ve all been there—laughing over drinks with friends, splitting checks that somehow spiral out of control. I used to dread Sundays, staring at my bank app, wondering where it all went. But after years of overspending guilt, I cracked the code. This isn’t about skipping outings—it’s about smarter choices that keep your wallet intact and your social life thriving. Let me walk you through the real, tested methods that changed how I handle social spending. These aren’t extreme cuts or awkward refusals; they’re practical shifts anyone can make. The goal isn’t deprivation—it’s balance. By understanding the psychology behind group spending and applying small, consistent strategies, I reduced my monthly social expenses by nearly 40% over two years—without missing a single celebration.

The Hidden Cost of Looking Cool

Social spending often begins not with a need, but with a feeling—an urge to belong, to appear successful, or simply to avoid standing out in the wrong way. It’s not just about the meal, the concert ticket, or the bottle of wine; it’s about the message it sends. For years, I believed that showing up at the newest rooftop bar or ordering the most expensive dish was a subtle way of saying, “I’m doing fine.” But in reality, I was sending a much louder message—to my future self: “You’ll pay for this later.” The cost of maintaining a certain image in social settings is one of the most underestimated financial drains, particularly among adults navigating friendships, career circles, and family gatherings where unspoken expectations run high.

Research in behavioral economics supports this. Studies show that people tend to spend more in group settings than when alone, especially when they perceive others as financially successful. This phenomenon, often tied to FOMO—fear of missing out—can quietly erode budgets. FOMO isn’t just about events; it’s about identity. Missing a dinner because of budget limits can feel like exclusion, even when it’s a conscious choice. The pressure to participate fully, to “keep up,” triggers emotional spending that rarely aligns with long-term financial goals. I once spent $280 on a single night out during a friend’s birthday bar crawl across three high-end lounges—more than I had allocated for dining out that entire month—because I didn’t want to seem “cheap” or disengaged.

Peer influence operates subtly but powerfully. When friends default to expensive habits—regular brunches at premium spots, last-minute weekend trips, or subscription-based group memberships—it becomes the norm. Deviating from that norm can feel socially risky. Yet, the financial toll accumulates fast. A $75 dinner twice a month becomes $1,800 a year. Add drinks, transportation, and incidental spending, and the total easily exceeds $2,500. Over five years, that’s more than $12,500—enough to fund a family vacation, make a significant credit card payment, or contribute meaningfully to a retirement account. The real cost isn’t just the money; it’s the opportunity cost of what that money could have done elsewhere.

The key to overcoming this pressure is awareness. Recognizing that social spending is often driven by emotion, not necessity, allows for more intentional choices. It’s not about rejecting social life but about reclaiming control. One effective strategy is to pause before agreeing to plans and ask: “Does this align with my current financial goals?” This simple question creates space between impulse and action. Another is to reframe value—not by what others might think, but by how the experience genuinely makes you feel. Did that overpriced cocktail make the night more memorable, or would a walk in the park with the same friends have created the same joy at no cost? Shifting focus from appearance to authenticity is the first step toward sustainable social spending.

Redefining Value in Social Experiences

Value in social experiences should be measured not by price, but by fulfillment per dollar. For too long, I equated cost with quality—assuming that a $50 brunch must be better than a $15 homemade spread. But after switching to picnic meetups in the park, I realized something surprising: the conversations were deeper, the mood more relaxed, and the overall satisfaction higher. The $30 I saved wasn’t just money—it was freedom. This shift in mindset—from price-driven to joy-driven spending—became the foundation of my new approach. It’s not about cutting out fun; it’s about maximizing it within financial boundaries.

One of the most effective tools I adopted was experience mapping—a simple practice of tracking which activities brought real emotional returns versus those that felt good in the moment but left me regretful later. I began journaling after social events, rating them on connection, enjoyment, and post-event financial comfort. Over time, patterns emerged. Group hikes, game nights at home, and coffee walks consistently scored high on connection and enjoyment, while high-cost dinners and club outings often ranked low on lasting satisfaction despite their expense. This data helped me make more informed decisions, not based on impulse, but on proven outcomes.

The concept of “joy per dollar” transforms how we plan social time. A $100 concert may deliver two hours of excitement, but a $20 museum visit with a friend could offer thoughtful conversation, cultural enrichment, and a memory that lasts much longer. Similarly, choosing off-peak hours at restaurants—like early bird dinners or weekend lunches—can cut costs by 30% or more without sacrificing quality. Many upscale places offer the same ambiance and service at lower prices during less busy times. Sharing meals is another underused strategy. Ordering two entrees to split among three people not only reduces cost but encourages variety and conversation around food choices.

Another powerful shift is focusing on experiences over objects. A round of drinks adds up quickly, but a free outdoor concert, a community art walk, or a volunteer event can create equally strong bonds. These activities center on interaction, not consumption, making them inherently more meaningful. I started hosting “theme nights” at home—international potlucks, movie marathons, or board game evenings—and found that friends appreciated the creativity and warmth more than any expensive outing. The savings were substantial, but the emotional payoff was even greater. Redefining value means asking not “How much did we spend?” but “How connected did we feel?” When joy becomes the metric, smarter spending follows naturally.

The Power of Pre-Planning with Friends

Spontaneity has its charm, but it’s also one of the biggest threats to a balanced budget. I used to say yes to last-minute plans without thinking, only to regret it days later when my account balance dwindled. The turning point came when I started suggesting plans in advance—not just casually, but with clear intentions. Instead of waiting for someone else to propose dinner, I’d say, “I’d love to catch up this week—how about a 6 PM reservation at that tapas place? I’ve heard their shared plates are great, and it’s within my budget.” To my surprise, no one objected. In fact, most friends appreciated the initiative.

Pre-planning does more than prevent overspending—it fosters transparency and mutual respect. When you suggest an outing with a built-in cost boundary, you’re not limiting fun; you’re setting a comfortable framework. This approach works especially well in group settings where decision fatigue can lead to defaulting to expensive options. By offering a specific, affordable suggestion, you guide the group toward a choice that works for everyone. Over time, this builds a culture of mindful spending within your social circle. Friends begin to anticipate budgets and even start suggesting low-cost ideas themselves.

One of the most effective pre-planning tools is the “spend cap” conversation. Before a night out, someone might say, “Let’s keep the total under $60 per person.” This isn’t restrictive—it’s empowering. It allows everyone to enjoy themselves without the anxiety of surprise costs. I’ve found that when expectations are set early, people feel more relaxed and present. There’s no awkwardness about who’s spending more or less, no pressure to order extra rounds. The focus stays on connection, not consumption. These conversations don’t have to be formal; they can be as simple as, “I’m trying to stick to my budget this month—any ideas for a fun but affordable night?”

Group accountability is another hidden benefit. When friends know you’re managing your spending, they’re less likely to pressure you into expensive choices. In fact, many people are silently struggling with the same challenges. By being open, you give others permission to be honest too. I once admitted to a close friend that I was scaling back on dining out to save for a home down payment. Instead of judgment, I received support—and she shared that she was doing the same. We started planning more home-based gatherings, which deepened our friendship and reduced financial stress for both of us. Pre-planning, therefore, isn’t just a budgeting tactic; it’s a relationship-building tool.

Smart Substitutions That Don’t Feel Cheap

Cutting social costs doesn’t require sacrificing quality—it requires rethinking options. I used to believe that a night out had to involve a restaurant or bar to feel special. Then I discovered gallery nights, which offered free entry, curated art, and a sophisticated atmosphere—without the $15 cocktail minimum. My friends loved it. We lingered, discussed paintings, and ended up having one of our most engaging evenings in months. That experience taught me that “cheap” doesn’t mean “low value”; it means “strategic.” The key is finding alternatives that deliver the same emotional payoff at a fraction of the cost.

Happy hour is one of the most underutilized tools for smart social spending. Many restaurants offer 20–50% off food and drinks during specific windows, often with the same ambiance and service as peak hours. A $14 appetizer becomes $7, and a $12 glass of wine drops to $6. By scheduling meetups during these times, you can enjoy the same experience for significantly less. The same applies to matinee movie showings, early-access museum hours, or off-season travel deals. Timing, not location, often determines cost.

Membership discounts and loyalty programs also offer quiet savings. Libraries, for example, often provide free passes to local museums, botanical gardens, and cultural centers. A simple online reservation can grant access to experiences that would otherwise cost $20 or more per person. Similarly, retail memberships like warehouse clubs or credit card rewards programs frequently include entertainment benefits—discounted tickets, restaurant credits, or event access. These perks are easy to overlook but can add up over time.

Local events are another goldmine. Cities and towns regularly host free concerts, food truck festivals, outdoor film screenings, and seasonal markets. These gatherings are designed to be social, lively, and inclusive—perfect for catching up with friends. I’ve replaced several planned dinners with visits to weekend farmers’ markets, where we sample treats, buy fresh produce, and enjoy the atmosphere. The total cost? Often under $10 per person. The experience? Just as rich, if not richer, than a formal outing. Smart substitutions aren’t about downgrade—they’re about upgrade through intentionality. When you choose based on value, not price tags, your social life becomes more sustainable and more satisfying.

Leveraging Technology Without Overspending

Technology has transformed how we socialize and spend, offering both convenience and temptation. I once relied heavily on food delivery apps, ordering dinners with a few taps—until I realized I was spending over $300 a month on takeout I didn’t truly enjoy. Subscription services added up too: streaming platforms, meal kits, and digital memberships I barely used. The ease of one-click payments made spending feel invisible. But the same tools that enable mindless consumption can also support financial control—if used with intention.

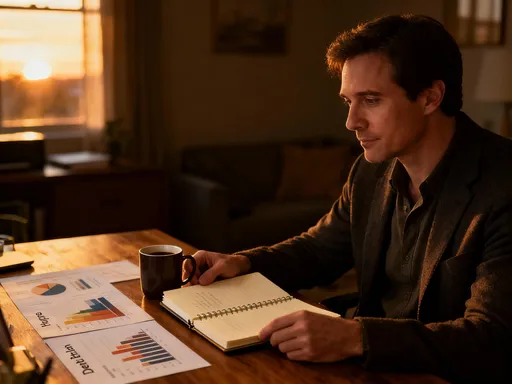

Budgeting apps, for example, can provide real-time awareness. By linking my accounts, I set monthly limits for dining and entertainment. When I approached my cap, I received alerts—gentle reminders that kept me on track. Some apps even categorize spending automatically, showing exactly how much I allocate to social activities. This transparency made it easier to adjust habits. Instead of guessing where my money went, I could see patterns: too many delivery orders, too many drinks on weekends, too many impulse buys during group outings.

Digital wallets and group-splitting apps also play a role. Platforms like Venmo or Zelle simplify cost sharing, reducing the awkwardness of splitting checks. But they can also normalize spending—if everyone is paying $50, you might feel compelled to join in, even if it’s over your limit. The solution is to use these tools as aids, not enablers. Before joining a group payment, I now pause and ask: “Does this fit my budget?” If not, I suggest an alternative plan or opt out gracefully. The app supports fairness, but I retain control over participation.

The real power of fintech lies in discipline, not convenience. Notifications can be customized to reinforce goals—daily balance updates, weekly spending summaries, or alerts when a category exceeds a threshold. I set mine to notify me when my social spending reached 80% of my monthly limit, giving me time to adjust. These tools don’t make decisions for you; they create awareness. When used mindfully, technology becomes a partner in financial health, not a gateway to excess. The goal isn’t to eliminate digital spending—but to ensure it aligns with your values and goals.

Building a Sustainable Social Budget

A budget fails when it feels like punishment. Mine collapsed repeatedly because I set rigid limits with no room for flexibility. I’d allocate $200 for the month, then face a birthday dinner that cost $60—and suddenly, I felt like a failure. The breakthrough came when I shifted from fixed numbers to percentage-based planning. Instead of a strict dollar cap, I began allocating 10% of my after-tax income to social spending. This allowed the budget to scale with my income and accommodate occasional splurges without guilt.

Flexibility is essential. Life includes unexpected invitations—anniversaries, farewell parties, holiday gatherings. A sustainable budget accounts for these. I now build in a “surprise fund” within my social category—about 20% of the total—so I’m not derailed by last-minute plans. This buffer reduces stress and prevents reactive overspending. Seasonal adjustments also help. I spend more during summer and holidays when social events naturally increase, and scale back during quieter months. This rhythm mirrors real life, making the budget feel realistic, not restrictive.

Emotional triggers are another critical factor. Stress, loneliness, or even excitement can lead to overspending. I noticed I was more likely to agree to expensive outings when I felt socially isolated or needed validation. Recognizing this pattern allowed me to address the root cause—spending time with friends at home, calling a loved one, or engaging in a hobby—instead of using spending as a substitute for connection. A sustainable budget isn’t just about numbers; it’s about understanding your relationship with money and social belonging.

The goal is harmony, not perfection. Some months I exceed my target; others I underspend. What matters is consistency over time. By treating social spending as a planned, valued part of life—not an afterthought or a source of guilt—I’ve created a system that supports both financial health and emotional well-being. This balance is what makes the budget last.

Long-Term Gains from Short-Term Discipline

The true power of mindful social spending lies in compounding benefits. Every time I chose a $15 lunch over a $35 one, I saved $20. That might seem small, but over a year, it adds up to $480. Over five years, that’s nearly $2,500—enough to cover a car insurance payment, fund a vacation, or invest in a low-cost index fund. These small decisions, repeated consistently, create financial momentum. They free up cash not just for emergencies, but for meaningful goals: home ownership, education, retirement, or travel.

More importantly, they build confidence. Each time I stick to my plan, I reinforce self-trust. I’m no longer at the mercy of peer pressure or impulsive choices. I’ve gained control—and with it, peace of mind. That freedom extends beyond money. I attend gatherings without financial anxiety, enjoy conversations without mentally calculating the bill, and say yes to what matters, no to what doesn’t. Social life feels richer, not because of what I spend, but because of how present I can be.

Discipline doesn’t mean deprivation. It means choosing with purpose. I still celebrate birthdays, attend weddings, and enjoy nights out. But now, I do so with clarity and intention. I’ve learned that the best moments aren’t bought—they’re shared. A walk in the rain, a long talk over tea, a homemade meal with laughter—these cost little but mean everything. By aligning spending with values, I’ve not only preserved my finances but deepened my relationships.

In the end, mastering social spending isn’t about cutting back. It’s about gaining more—more freedom, more security, more joy. It’s about building a life where money supports your happiness, not undermines it. And that’s a balance worth striving for, one smart decision at a time.